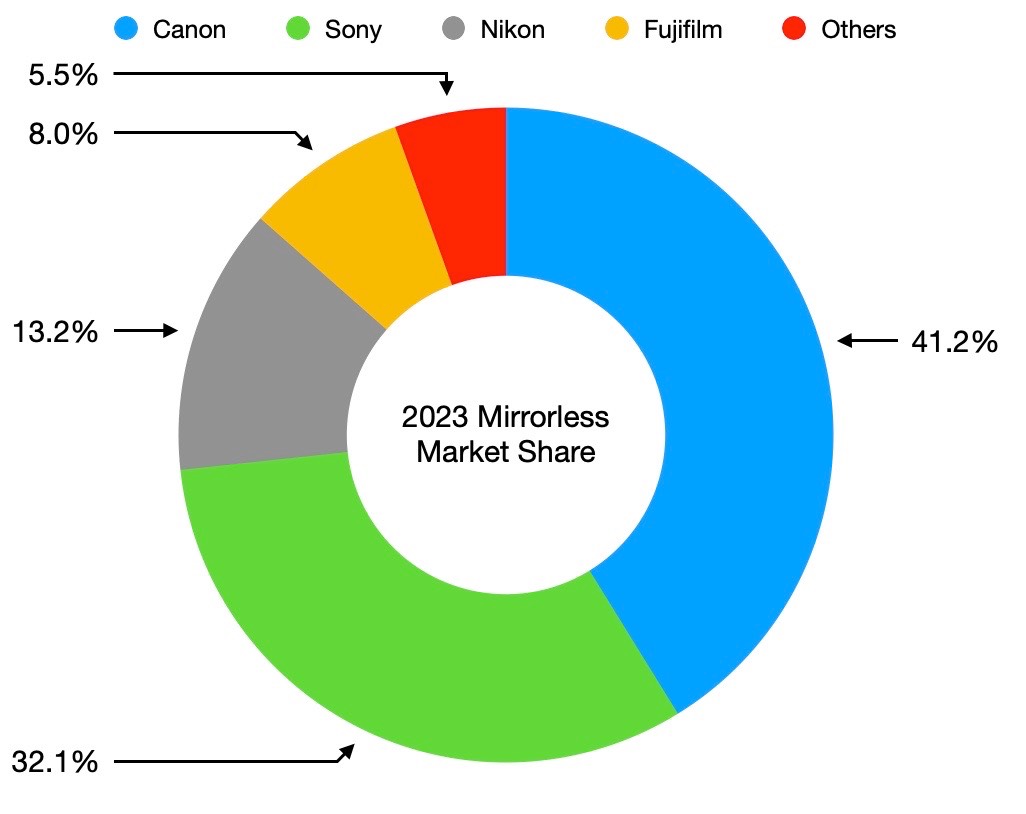

No sooner did Nikkei publish their mirrorless market share report (chart summarizing that, below), did the amateur statisticians once again whip up their completely wrong analysis, one of whom went to the trouble of asking ChatGTP for help. But garbage in, garbage out.

One problem is that these amateur statisticians have trouble with reading comprehension. The report Nikkei quoted was for mirrorless market share, not complete camera market share. That didn’t stop one site from pulling up full camera share reports for previous years from different sources, and come to the conclusion that Canon is in trouble (if you want a more accurate analysis of what’s happening in the market, see mine).

Taking three sources with no overlap to create a pattern over four years to predict for ten years forward is a big statistical no-no. But no, this particular site then took that multi-sourced and non-conforming data and had AI do the hard work of coming up with projections from it. That led them to the conclusion that Canon will have a 7.7% market share in 2033, and Sony an 82.1% market share.

To add humor, not only did we get that ridiculous projection, but said poster couldn’t even read his own fake table. He wrote “Nikon...will continue to grow steadily.” But his table says 12.95% in 2024 down to 10.7% in 2033, which as you’re probably aware, is not what anyone would call growth. If it is, Nikon has been growing like gangbusters for several years now ;~).

Anyone can do statistics these days. Even political pollsters. The problem is that those are almost never accurate use of statistics, and thus the reliability of all these amateur projections we see these days is essentially zero.

Even for someone like me, whose PhD minor was in statistics, it’s difficult, as the reliability of data has gone down, too. About the only two consistently reliabible data points in cameras that are publicly available now are the CIPA monthly numbers, plus Nikon’s quarterly financial statements. But even those are difficult to square together, because Nikon still reports all ILC while CIPA breaks mirrorless and DSLRs out.

When I made my 2003 projection of peak DSLR being reached sometime in 2011 (I was off by about six months), I did that from four known, reliable data sources. Unfortunately, one of those is now private and another no longer reliable. Moreover, the projection didn’t rely upon the camera market volume directly, but rather home adoption. One of the things I discovered in my PhD work is that future volumes can be predicted by household penetration numbers. I’d point to my long study of this, but I can’t find a copy at the moment.

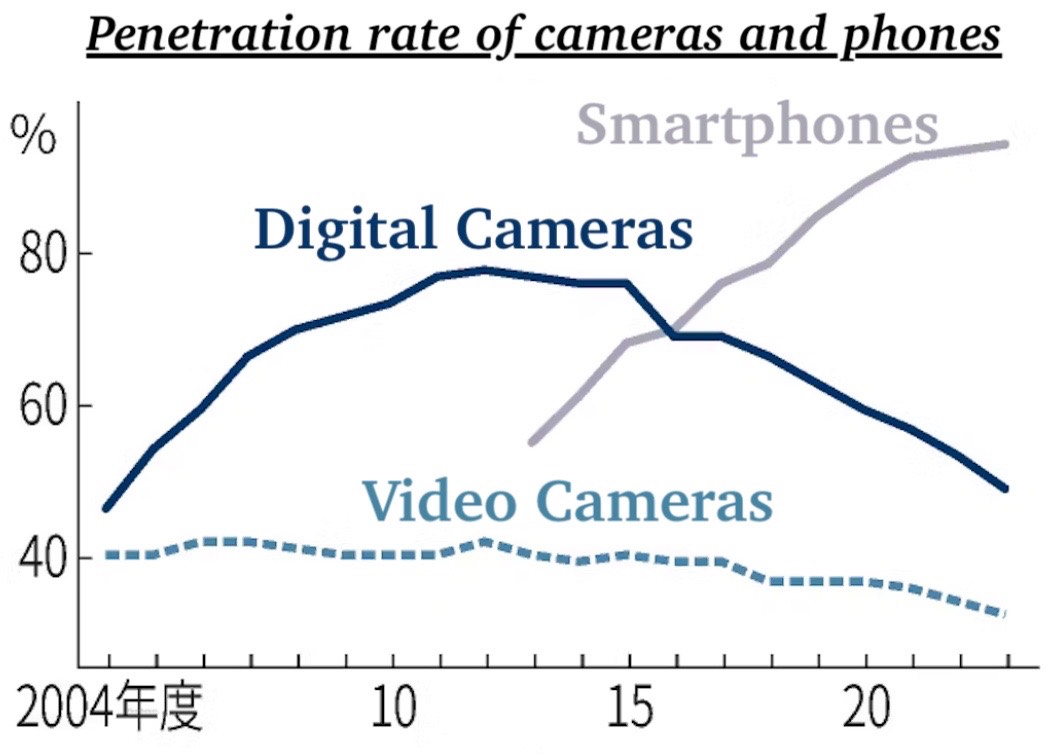

You might also have noticed this chart making the rounds (again from Nikkei):

Note the hump. This tells us that every home in Japan decided they needed a digital still camera, so household penetration went up; so did camera sales, obviously. But as smartphones started taking over the photo job, Japan has returned to more where they were in terms of number of dedicated cameras in each home.

This is exactly the area I’ve been studying for quite some time. It’s what made me suggest that we’d fall well below 6m unit sales before we did. Unfortunately, the available data to me at the moment is not global and for only a couple of markets, but the suggestion to me is that somewhere in the 4m to 6m range is the nominal long term level of camera sales. I see a little uptick in average ownership among the young recently, but it’s unclear yet whether that’s just faddish or a real new trend that will push the number upward.

If I’m right about a relatively flat overall market long term (or even a slow decline), this makes market share strategies really important. As I note in my sansmirror article, I see everything is upside down right now: one of the smaller market shares is making the highest per unit profit, which usually doesn’t hold for long.

There’s little doubt that Canon is under stress right now. Their long-term strategy of targeting half the market (50% market share) is not likely achievable in the short term without dramatic cost cutting as well as ratcheting up product discounts. By dramatic, I mean more than they’ve already done.

Since everyone else is doing junk statistics, I’ll do a junk prediction here (though partially based upon a broad knowledge of how all this works): within three to five years, Canon’s camera market share will have dropped probably ten points, Nikon will have gained five points, and the Big Three ILC shares will look more like Canon 40%, Sony 30%, Nikon 15%, all ±2. Oh, wait, that’s exactly where we are with the current mirrorless market ;~). Maybe not so junk, after all.