It’s that time of year when various Web sites across the photographic world all jump on BCN’s published figures for the domestic Japanese market. This is often done due to cheerleading for a specific brand, particularly on rumor sites.

Those of you with short memories will remember that I was one of the first, if not the first, Western site—not just photography site, mind you—to publish CIPA, BCN, NPD, and other numbers just after the start of the new century in order to provide support for my analysis of what was going on in the camera business. I predicted in 2003, for instance, that peak ILC (interchangeably lens camera) sales would occur in 2011; I was off by a year, as the quake, tsunami, and flood distorted the numbers in 2011 and 2012.

I’ve moved away from doing such analysis when it became clear sometime last decade that things would follow the next path I had outlined: a collapse to some minimum number of sales. Basically, once I felt my analysis had been well supported with data, I saw no real reason to continue doing constant reporting of same. We’re still in an era where ILC sales will flirt with a bottom, and whether that bottom is 4 million, 5 million, or as much as 6 million units is difficult to say at the moment, as all sorts of problematic forces have been triggered by the pandemic and its side effects. To put it bluntly, lower volume with a price shift is still on: the Japanese camera companies are selling fewer product than they used to, so they want to try and make that product a more expensive one so as to keep their revenues up.

They’ve done a good job of that. In 2021 (the last full year CIPA has statistics for) the total revenue was 488b yen. While 2017/18 were both at nearly 800b yen, consider that 10.7m+ ILC were sold in 2018, while 5.3m+ were sold in 2021. So units dropped by ~50% while money taken in dropped by 39%. That trend will continue for the foreseeable future.

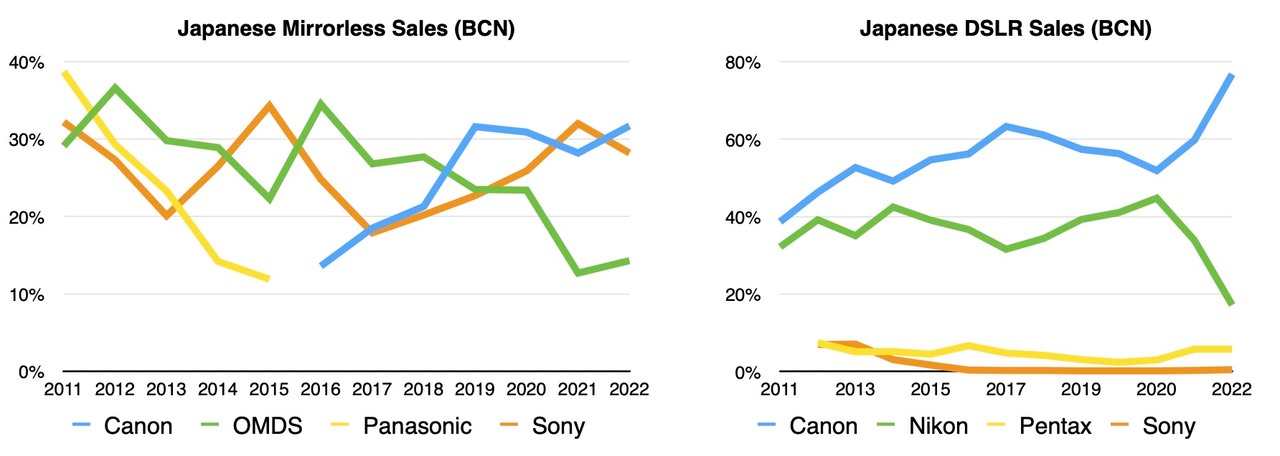

But what I wanted to write about today is the very narrow view which the sites that are citing BCN numbers are taking. First, of course, BCN only monitors about half the sales sites in Japan, and mostly consumer ones at that, not the big camera stores. Second, these articles only tend to talk about this year versus last and who’s on top (“Canon has taken over from Sony as the top mirrorless camera producer”). The historical data tells you a lot more, and raises some interesting questions:

Let’s start with mirrorless in Japan: where’s Fujifilm and Nikon? Well, BCN only reports the top three players in their yearly “awards.” In 2022, Fujifilm, Nikon, and Panasonic shared about 26% of the Japanese market.

But there’s a lot that’s unsaid in those numbers. If you look at the monthly sales lists from BCN you see what drives the unit volume, which is what the “awards" are based on: low cost cameras, and often earlier generation ones on sale. So the Canon M and OMDS PL models do well. Nikon’s Z30/50/fc tend to be too-high priced for the consumer store buying that BCN tracks. Moreover, move over to the DSLR numbers: Nikon’s been doing something interesting as they appear to be de-emphasizing shipments into Japan in favor of shipments into other companies where they can maximize returns. I’ve reported before that Nikon’s bean counters are wickedly efficient at both cost cutting the bean as well as moving beans around to maximize their ROI.

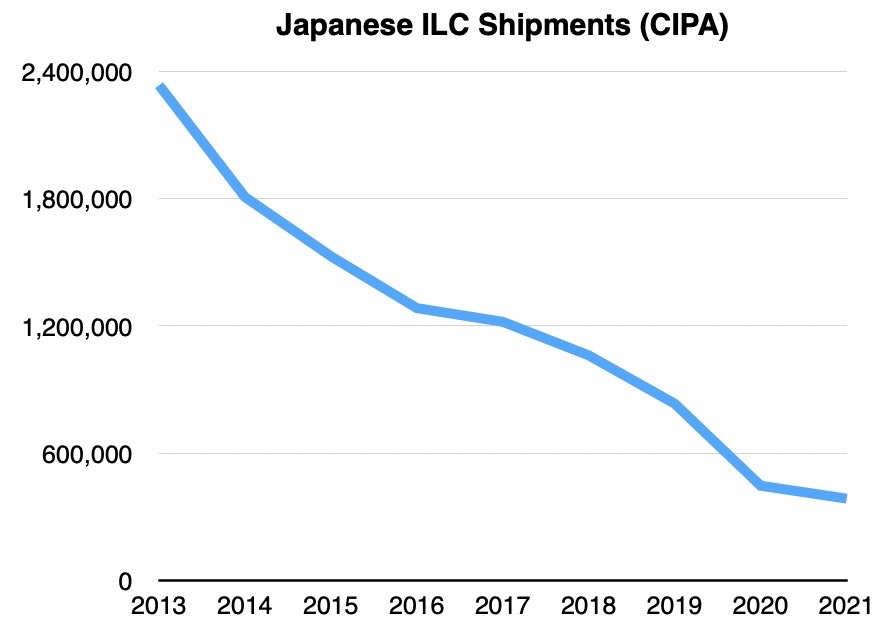

However, there’s another thing I wanted to point out that just doesn’t get mentioned in all these “BCN reports new winners” articles. Take a look at this chart:

That’s ILC shipments (CIPA) into the domestic Japan market during much of the same time period shown in the previous graphs. That’s an 83% drop in volume in Japan, the market that’s being crowed so much about who’s winning. Worldwide, camera shipments declined only 69% in that same time period, which just reinforces what I wrote about Nikon beans: camera companies are not necessarily prioritizing Japan with their products, they’re prioritizing where they can take in the most dollars (yen) from them.

I could go on, but I’m trying to get out of the analyst business (Disclosure: I used to have a client for that work, but for several years no longer do). Nevertheless, I wanted to point out that there’s much more behind the story than you’re reading elsewhere. Do I care whether Canon, OMDS, or Sony sold more US$500 mirrorless cameras through consumer outlets in another downmarket in Japan last year? No, and neither should you.

The much more relevant numbers to watch are in the financial statements, and these have to do with cash flow and ROI. Those are the two things that all the Japanese companies are currently managing to, and how they evaluate their success (and even viability). We’ll have another round of quarterly financial statements soon that speaks to those numbers, and my expectations are that everyone reports reasonably rosy returns. The industry may be smaller than before, but as far as the companies that report out their Imaging group numbers, they all seem to be healthy at the moment. That would be Canon, Fujifilm, Nikon, and Sony. (Panasonic, OMDS, and Ricoh/Pentax currently do not report numbers that would allow us to understand how their camera businesses are doing.)